Developing Effective M&A Approaches

M&A Forum Chicago

SEPTEMBER 25, 2025

3:30 - 4:00pm

Welcome and networking

4:00 - 5:45pm

Discussion on key challenges and innovation in the M&A process

- Developing key steps in the target identification and development process

- Crafting clever diligence methods, negotiation techniques, and deal points

- Designing innovative approaches for retention & cultural alignment

- Engineering post-close performance improvement

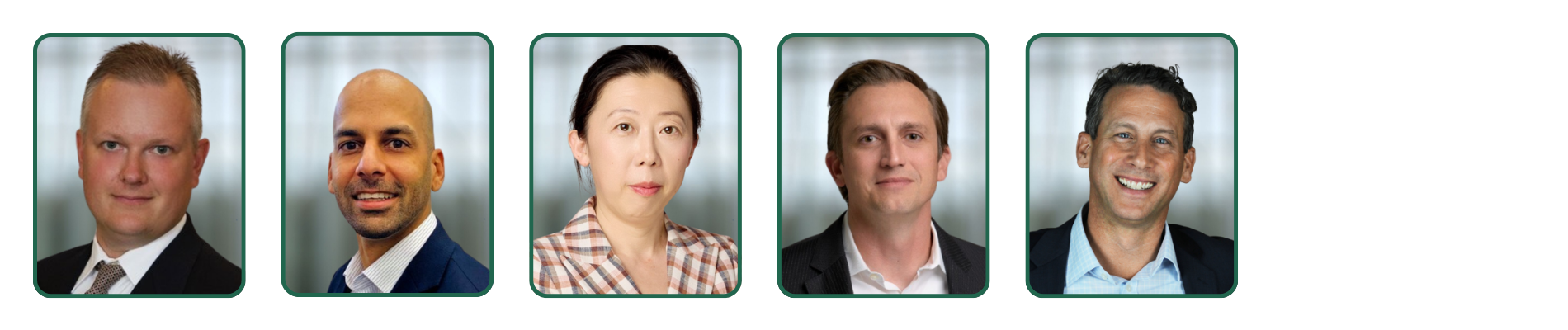

Rich Michalek, Global Director - Business Development and Mergers and Acquisitions, ADM

Rich Michalek, Global Director - Business Development and Mergers and Acquisitions, ADM

Rupe Gill, Partner, Deals, PwC

Ye Bu, Managing Director, Strategy & Business Development, GE Healthcare

Jason Baab, Vice President Corporate Development, Strategy & Sustainability, Toro

William Jefferson Black, Executive Director, Transaction Advisors Institute (Chair)

5:45 - 7:00pm

Continued discussions and networking over wine & appetizers

Program Materials

Participants will receive both digital and print materials with information on recent shifts in deal volume, negotiation points, and best practices, including the selection below

Exclusively for Corporate M&A Professionals

M&A Forum Chicago

The University Club

76 East Monroe Street, Chicago, IL 60603

Thursday, September 25, 2025

3:30pm - 7:00pm

Learn About Membership Accounts

Registration is not open to M&A consultants, advisors, vendors, or members of the media.

Unqualified registrations will be canceled and refunded, less a $100 bank processing fee.

This program is generously underwritten by